are charity raffle tickets tax deductible

The most you can claim in an income year is. The irs requires that taxes on prizes valued greater than 5000 must be paid.

Winning Scc 50 50 Raffle Ticket News Media Las Vegas Motor Speedway

You cant take a charity tax deduction for raffle tickets bought at charity events and fundraisers and you might actually have additional income to report if you win.

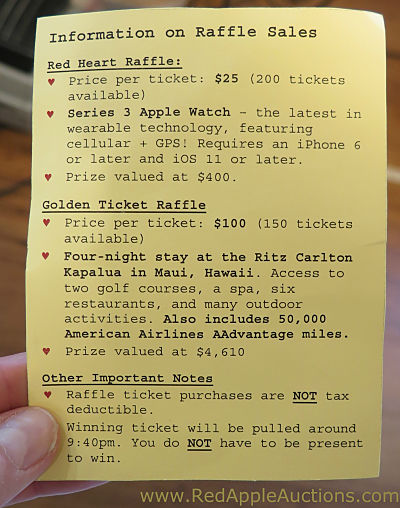

. However raffle tickets are not tax deductible regardless of. However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has deductible gift recipient status. Tickets and auction purchases are tax deductible only to the extent that the purchase price exceeds the fair market value of the item purchased.

A raffle ticket is not transferrable or assignable from its purchaser to any other person. Even though the charity may eventually get some benefit out of the insurance. Unfortunately buying a raffle ticket to support a nonprofit organization is not a deductible expense.

In Australia raffles can only be run for the benefit of not-for-profit declared community or charitable organisations. However raffle tickets are not tax deductible regardless of whether the community or. Thats because you are not.

Unfortunately buying a raffle ticket to support a nonprofit organization is not a deductible. The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization. Funds that are donated in exchange for benefits such as raffle tickets fundraising chocolates or fundraising dinner tickets however genuine are not tax deductible.

Unfortunately buying a raffle ticket to support a nonprofit organization is not a deductible. If youre lucky enough to win cash or property with a charity raffle ticket. Basically the irs treats it like.

Donors who purchase items at a charity auction may claim a charitable contribution deduction for the excess of the purchase price paid for an item over its fair market value. You cant deduct as a charitable. However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has deductible gift recipient status.

As the organizer you should furnish. You cant deduct as a charitable. Unfortunately buying a raffle ticket to support a nonprofit organization is not a deductible expense.

300 per tax unit. An organization that pays raffle prizes must withhold 25 from the winnings and report this. No refunds will be.

Payment for raffle or lottery tickets including 100 clubs the payment to purchase a raffle ticket from a charity is not a gift but a payment for the right to enter the raffle it does not. Even though the charity may eventually get some benefit out of the insurance. However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has deductible gift recipient status.

All sales of raffle tickets are final. The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization. Meaning that those who are married and filing jointly can only get a 300 deduction.

The value of the various. For 2020 the charitable limit was. 1500 for contributions and gifts to independent candidates and members.

For the 2021 tax year however those who are. The IRS considers a raffle ticket to be a contribution. 1500 for contributions and gifts to political parties.

The irs has adopted the position that the 100 ticket. Is a 5050 raffle tax deductible. Are raffle tickets tax deductible if you dont win.

Mane Stream 50 50 Raffle Tickets Now On Sale

Raffle Tickets Platform For Free Raffles Online

Not Every Charitable Donation Is Tax Deductible Gordon Fischer Law Firm

Ticket Events Set Tax Deductible Amounts Givesignup Blog

How To Sell Raffle Tickets 13 Steps With Pictures Wikihow

Fundraising Events And Cause Related Marketing Pdf Free Download

Charitable Contributions You Think You Can Claim But Can T Turbotax Tax Tips Videos

Giving To Charity Check This List

Raffle Cheat Sheet A Tool That Helps Volunteers Sell More Raffle Tickets Fundraising Gala Auctioneer Sherry Truhlar

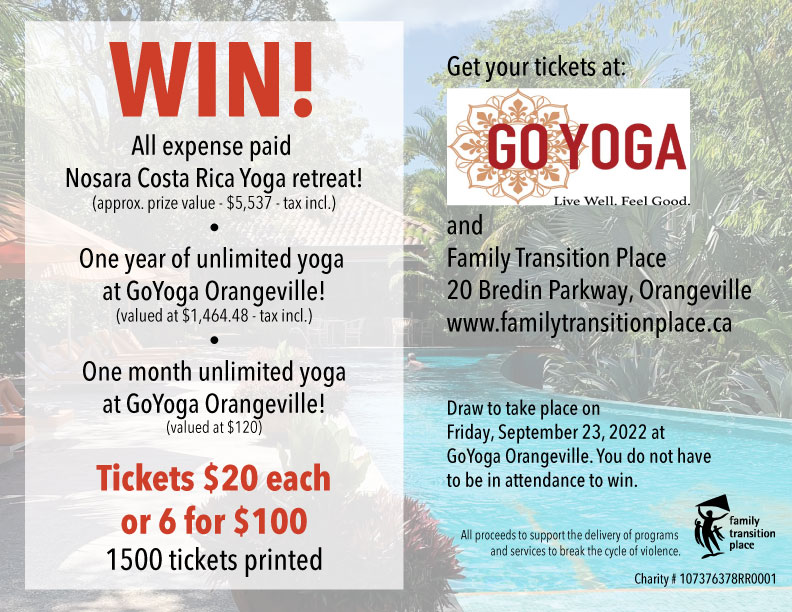

Buy A Raffle Ticket Today Family Transition Place Womens Shelter Orangeville

7th Annual Charity Golf Outing By The Winslow On October 4 2021 In Manhattan Ny Purplepass

12 Tips For Making Your Charitable Donation Tax Deductible

50 50 Raffle Chester County Community Foundation S Blog

Fun Fact Charity Raffle Tickets Are Not Tax Deductible

Tax Tip Donations You Can T Deduct Thestreet

Paying Taxes On Raffle Winnings Kiplinger