rsu tax rate us

This rate is 238 20 plus the 38 tax on net investment income for high-earning taxpayers. Selling RSU vested shares this year to avoid the Medicare Surtax next year 3.

Restricted Stock Units How Rsus Affect Your Clients Taxes Tax Pro Center Intuit

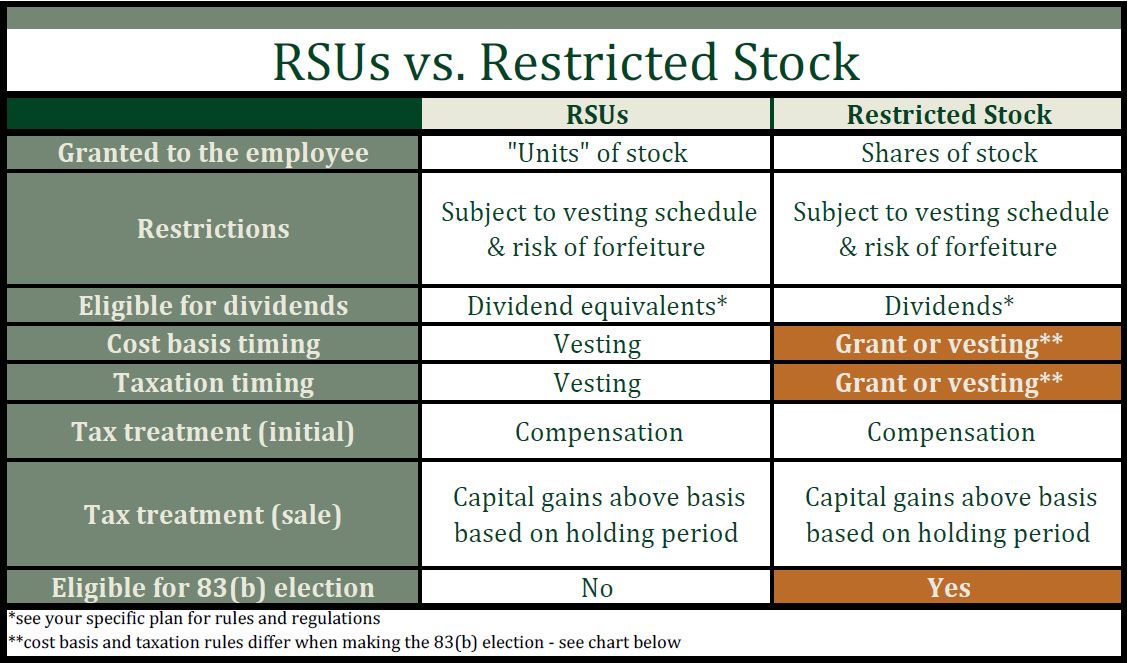

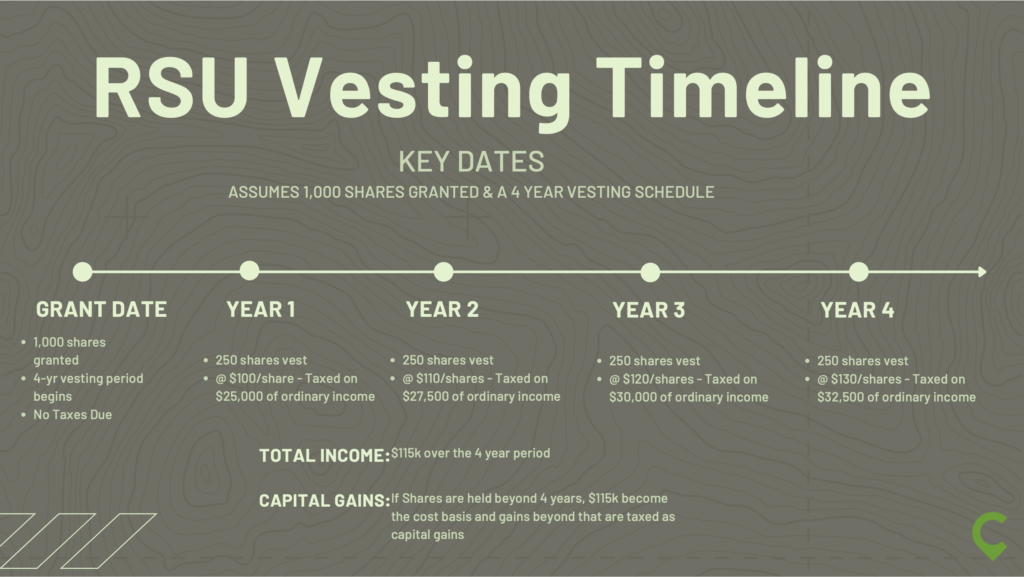

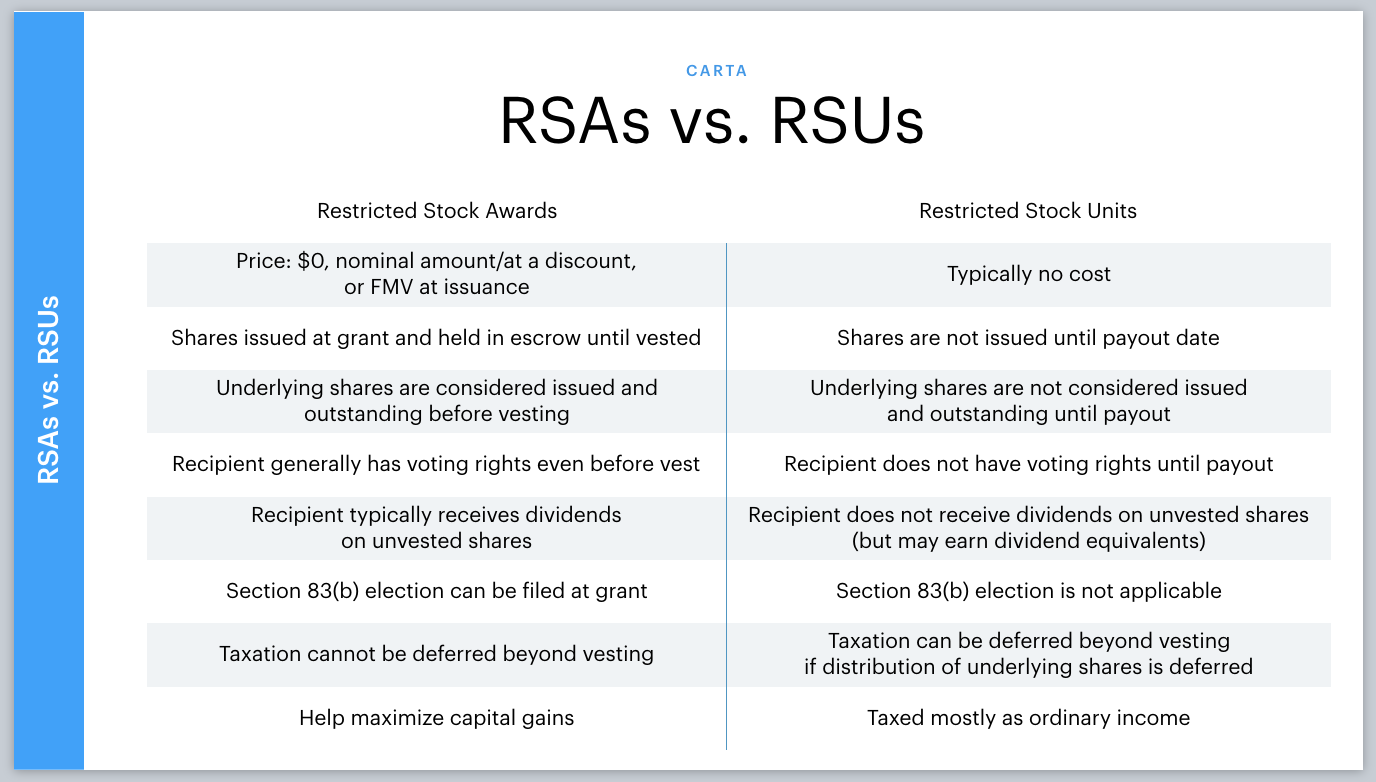

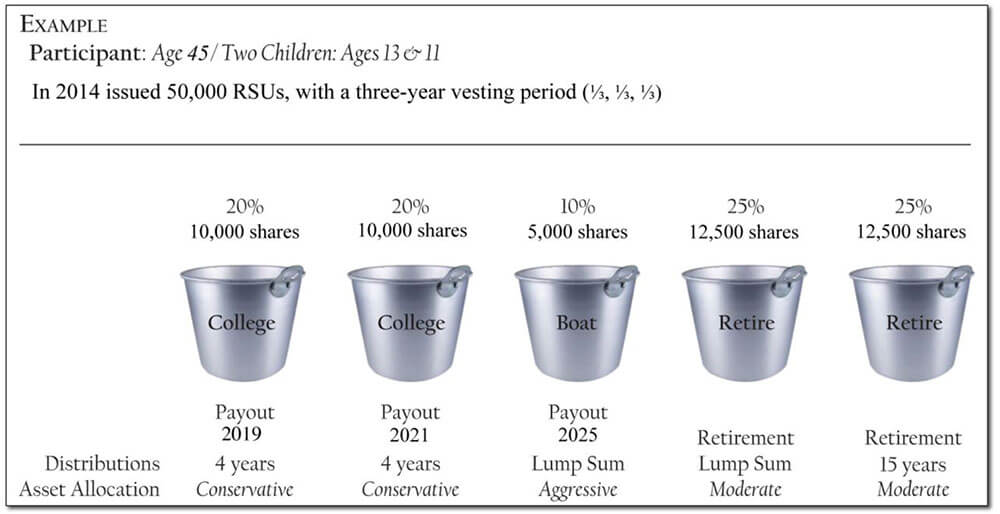

Restricted stock units RSUs and stock grants are often used by companies to reward their employees with an investment in the company rather than with cash.

. If you already earn in excess of this and the RSUs take you over 150000 you will pay 45 income tax plus the employers National Insurance. If the RSUs take you over 100000 you will pay income tax at a marginal rate of 60 plus the employers National Insurance. As a CDN tax resindet you will always be taxed with CDN tax rates.

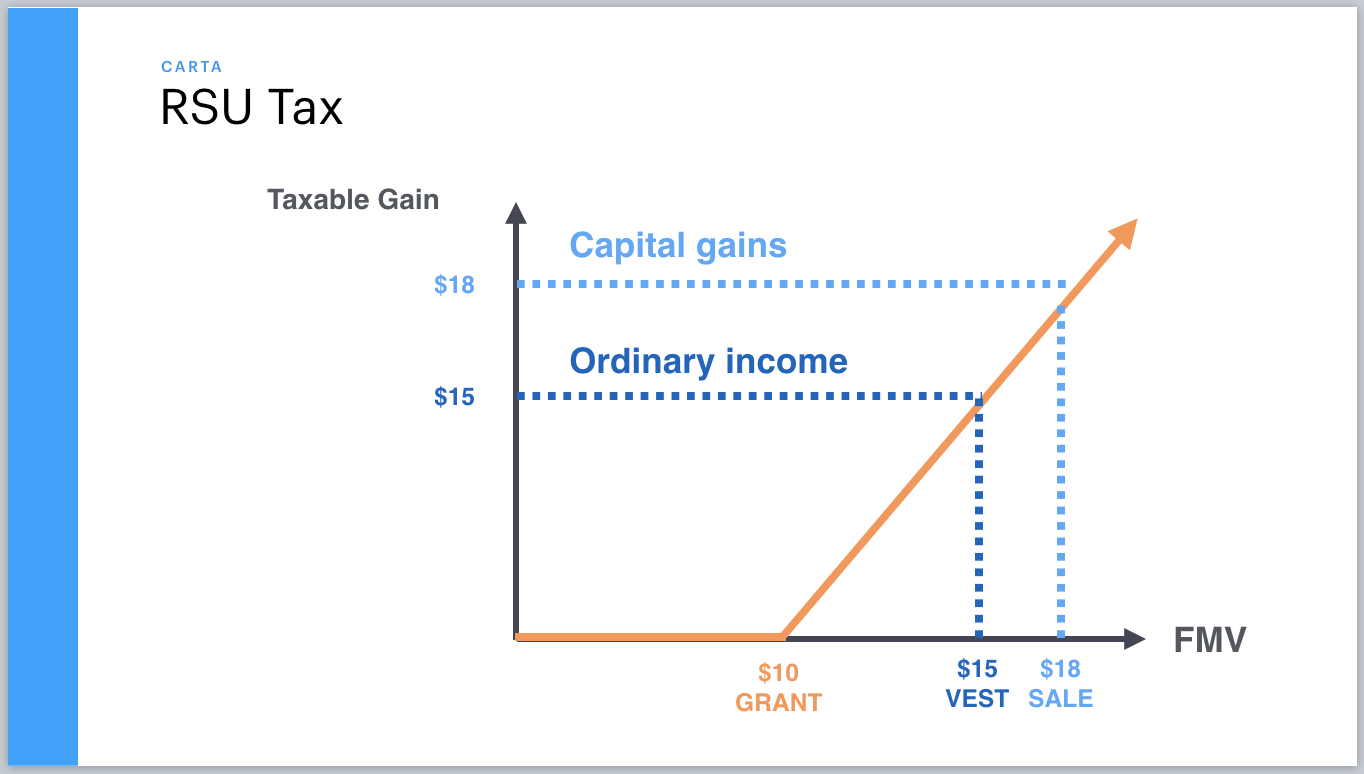

Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock purchase plans ESPPs. 514-393-6507 Amélie Desrochers Tel. RSUs are taxed as W-2 income subject to federal and employment tax Social Security and Medicare and any state and local tax.

In some states such as California the total tax withholding on your RSU is around 40. How your stock grant is delivered to you and whether or not it is vested are the key factors. For people working in California the total tax withholding on your RSUs are actually around 40.

Taxation of RSUs. Yes the RSU can qualify under this exception to the general rule if the timing of the receipt of compensation is correct. The RSUs are subject to NI and income tax at your marginal rate on their value at the time they vestYou can either choose to pay the tax yourself and receive all the sharesbut most people will opt to have shares deducted to pay for these deductionsSo if you are a higher rate tax payer you will be due to pay 42 tax and NI which would mean your 50 shares would.

Generally there is no tax upon the sale of shares if the shareholder together with their fiscal partner has an interest less than 5 percent in the nominal subscribed share capital determined per class of shares. As the name implies RSUs have rules as to when they can be sold. At any rate RSUs are seen as supplemental income.

Assuming the stock price increased to 250 per share on 122020 you must pay income taxes on the RSU income of 7500 30250. The IRS and your state and local tax authorities if applicable view this 7500 as compensation income. On the other hand the rate for short term gains is the same as that for earned income which is 37 for high-income taxpayers.

Unless specific facts and. The RSUs you get will be taxed about half de to it being income and when you sell capital gains whether you sell form the US or Canada. Log in or sign up to leave a comment.

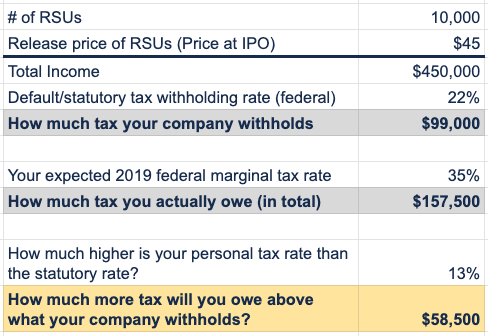

Can an RSU be excepted from the general rule as a 3-year SDA. 8 rows What about tax withholding on my RSU income. Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer.

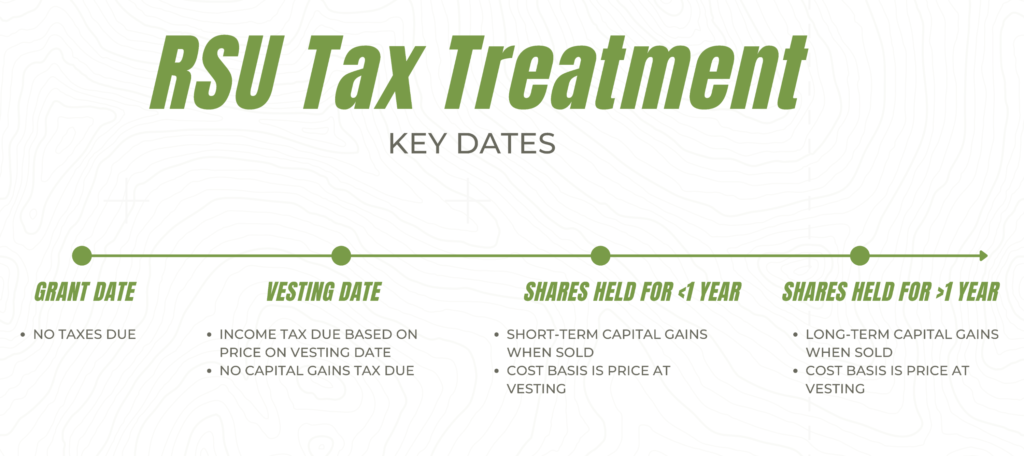

Unless the RSU fits within an exception an employee pays tax on an RSU when he receives a unit the right to receive cash or shares as compensation. Stock grants often carry restrictions as well. The taxation of RSUs is a bit simpler than for standard restricted stock plans.

RSUs or Restricted Stock Units work a little differently than traditional restricted stock. At the short-term capital tax rate which will be the same as your ordinary income tax rate. RSU Tax Rate.

Like restricted stock recipients those who are granted RSU stock must meet certain requirements. 613-751-6674 Chantal Baril Tel. Enter details of your most recent RSU grant your companys vesting schedule and some assumptions about your tax rate and your employers future returns.

Those plans generally have tax consequences at the date of exercise or sale whereas restricted stock usually becomes taxable upon the completion of the vesting schedule. RSUs are taxed at the ordinary income tax rate when they are issued to an employee after they vest and you own them. RSUs can trigger capital gains tax but only if the stock holder chooses to not sell the stock and it increases in value before the stock holder sells it in the future.

Canadian Tax Legal Alert CRA issues new views on RSU taxation in Canada April 21 2021 Contacts. Unlike the much more complicated ESPP they get taxed the same way as your income. Restricted stock is technically a gift of stock given to a company executive while an RSU is a promise of future stock.

The 22 doesnt include state income Social Security and Medicare tax withholding. Most companies dont withhold taxes according to. Rsu tax rate us Sunday March 6 2022 Edit Tax treatment of RSUs in India The RSU perquisite is taxable based on the period of stay during the vesting period and resident status at the time of the grant of option.

The value of over 1 million will be taxed at 37. This 7500 income from RSU vesting is called supplemental wages by the IRS. Restricted Stock Units RSUs Tax Calculator.

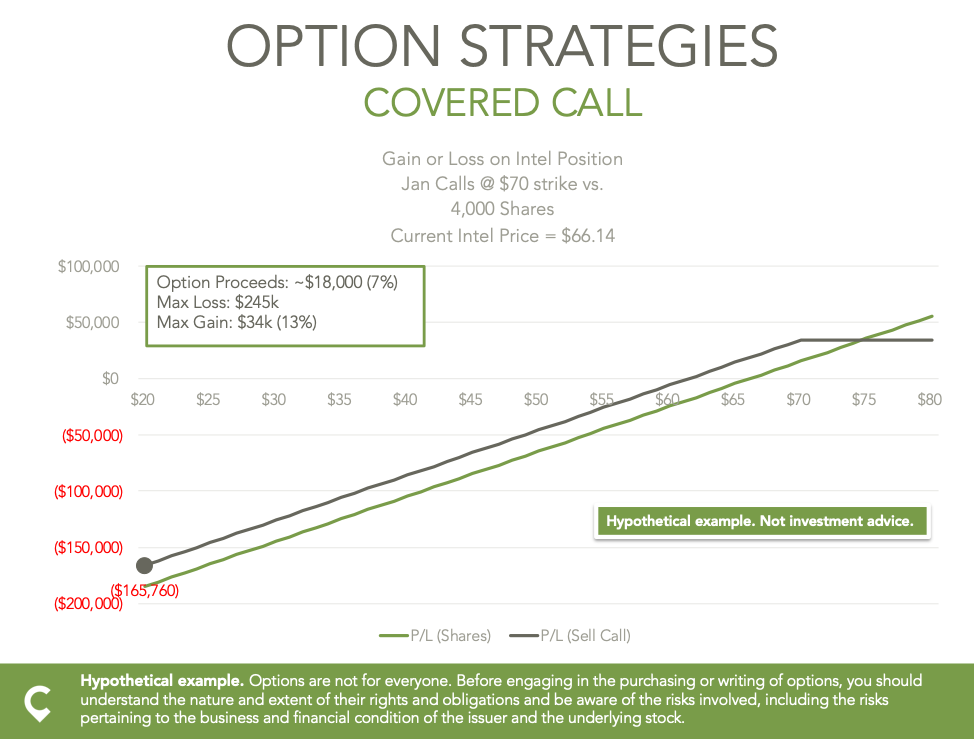

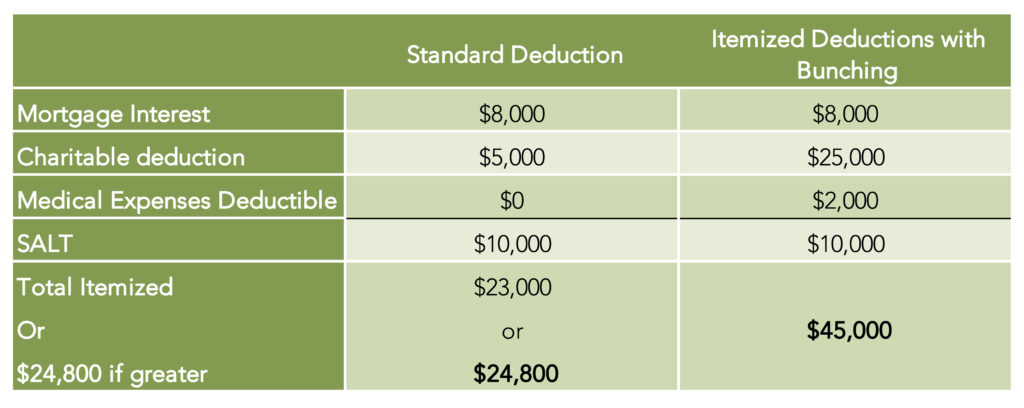

Deferring income around RSU Income 2. RSUs are taxed upon the delivery of shares which is generally upon vesting as income from employment at the progressive tax rate up to 495 percent. The beauty of RSUs is in the simplicity of the way they get taxed.

This doesnt include state income Social Security or Medicare tax withholding. From there the RSU projection tool will model the total economic value of your grant over the years. This may involve meeting personal or.

Pay next years state income tax and. For a NRA the taxable event will require withholding at source when you exercise the RSU when the income is distributed to you. If you live in a state where you need to pay state income taxes repeat steps 2 and 3 using your state marginal tax rate.

Hope you had a chance to glance over at the official Restricted Stock Unit RSU Strategy Guide. There is normally a 30 withholding required but a treaty Article if there is a treaty between the US and the country of the NRA that could be lower. Now that you know the basics of how RSUs work you can now confidently use the RSU Tax Calculator Below.

Here is the information you need to know prior to jumping in. Because there is no actual stock issued at grant no Section 83 b election is permitted. On this page is a Restricted Stock Unit Projection calculator or RSU calculator.

RSUs are treated as supplemental income. Most companies will withhold federal income taxes at a flat rate of 22. Long-term are capital items like RSUs that are held for more than one year after they were grantedobtained.

Many companies withhold federal income taxes on RSUs at a flat rate of 22 37 for amount over 1 million. With that understanding we can now move on to the year-end tax strategies for RSUs which are. 514-393-5554 The Canada Revenue Agency CRA has issued new commentary 1 with respect to taxation of restricted stock units RSUs.

In other words if the stock increase in value after youve paid ordinary income tax. Log In Sign Up.

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

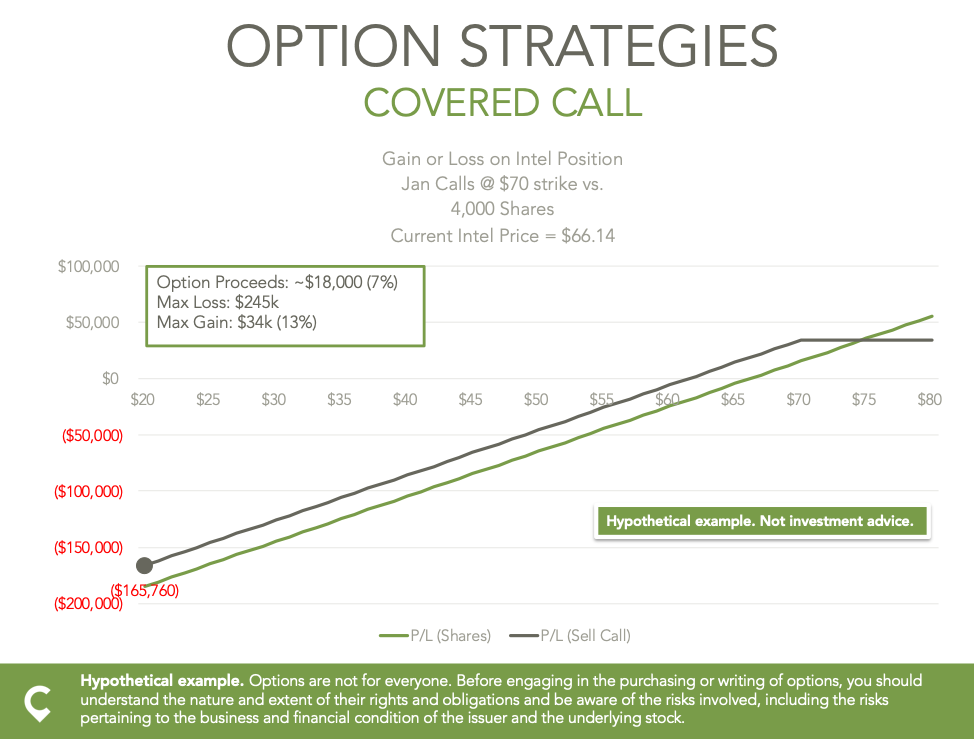

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Navigating Your Equity Based Compensation Restricted Stock Restricted Stock Units Verum Partners

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Restricted Stock Units Jane Financial

A Tech Employee S Guide To Rsus Cordant Wealth Partners

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Restricted Stock Units In Nqdc Plans Executive Benefit Solutions

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium